Beginning this year, owners of small businesses must comply with the reporting requirements of the Corporate Transparency Act (CTA). This important legislation requires most owners and managers of closely held corporations, limited liability companies (LLCs) and limited partnerships (LPs) to report “beneficial ownership information (BOI)” to a federal database run by the Financial Crimes Enforcement Network (FinCEN). This new requirement impacts landowners managing their property through LLCs and LPs.

Congress, in enacting the CTA, is seeking to “provide law enforcement with beneficial ownership information [about small business entities] for the purpose of detecting, preventing and punishing terrorism, money laundering and other misconduct through business entities.” Often, such nefarious activities are conducted through these business structures.

How does this affect owners of rural land?

To be effective, the requirements apply broadly to most small business owners. While there are some exceptions, most small farm and ranch entities must file a report. Business entities already subject to federal reporting requirements may be exempt from the CTA-mandated reporting such as financial institutions, businesses subject to securities regulations, non-profit organizations, and publicly held businesses. The statute requires information about both the “Reporting Company” (the entity obligated to file the report) and each “Beneficial Owner.” Closely held corporations, LLCs, and LPs (including single-member LLCs) are Reporting Companies. A Beneficial Owner is an individual who, directly or indirectly, either exercises substantial control over a reporting company or owns or controls at least 25% of the reporting company’s ownership interests.

When is the filing due?

| Reporting Deadlines | |

|

Existing Business Entities (Created before January 1, 2024) |

January 1, 2025 |

|

New Business Entities (Created on or after January 1, 2024) |

90 calendar days after receiving notice that the entity’s creation or registration is effective |

Business entities formed after January 1, 2024 must file a report with FinCEN within 90 days after the entity is formed. Small business entities in existence before January 1, 2024 have a full year to comply, with their deadline being January 1, 2025. This is a one-time filing. There is no annual reporting, but small businesses will be required to update their report when ownership or control changes. Examples of changes include admitting a new member or partner who has at least a 25% interest in the LLC or LP or changing a Manager.

What if I fail to file the Report?

Willfully filing false information or willfully failing to file a report can result in high fines and possible imprisonment. The escalating fines range from $500/day to $10,000/violation and jail time of up to two (2) years.

What next steps should be taken?

Reach out to Braun and Gresham. We will help you confirm whether the requirements apply to your corporation, LLC, or LP. Then, we will assist you with compiling and reporting the required information.

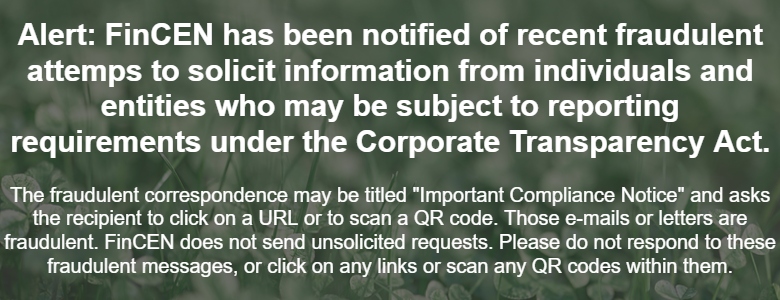

Do not respond to any email or other solicitation that appears to be from FinCEN. As with any new program, misinformation is abundant. FinCEN has posted the following notice:

For additional information, contact mstellfox@braungresham by October 15th, 2024.